Last year, the NAND industry produced around 5 exabytes of extra supply. That is 5,000,000,000 GB’s (the equivalent to 5 million 1TB SSD’s) worth of extra parts just sitting around! When that happens, you have an oversupply situation and prices decline dramatically. NAND vendors absolutely hate this.

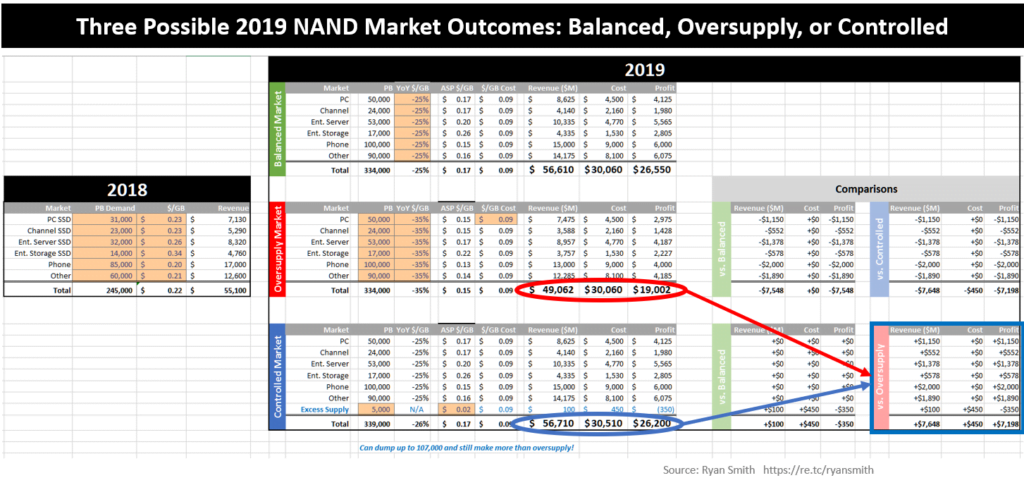

In a balanced market, you could expect anywhere between 20-25% YoY price declines. However, due to the massive oversupply, analysts are expecting around 35% YoY declines for 2019.

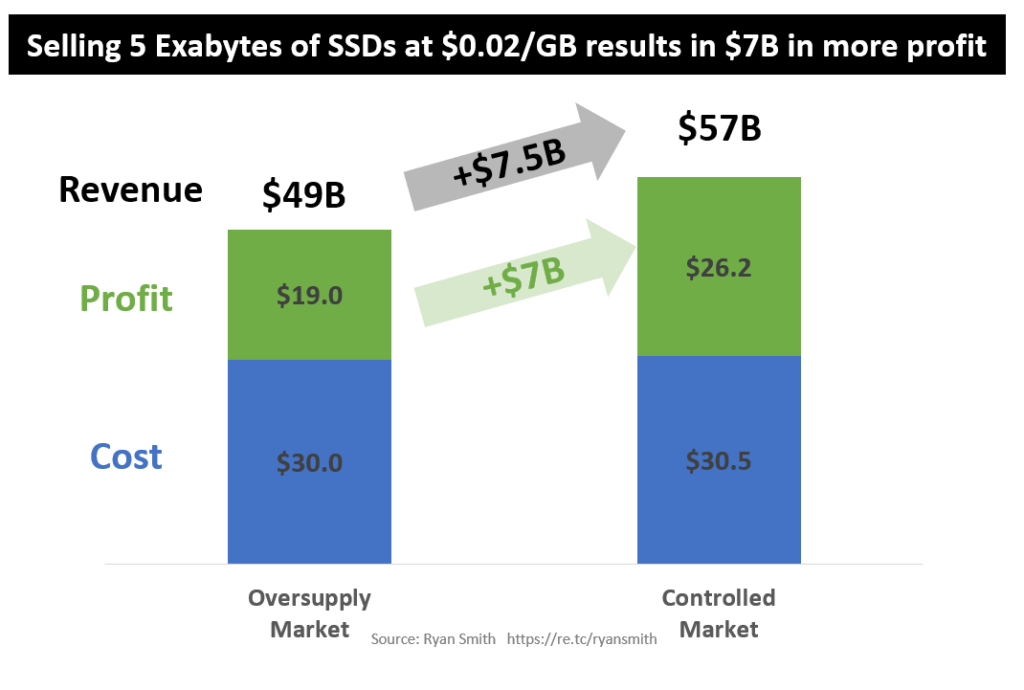

To put this into perspective, for every $0.01 (penny) in price declines that happen, that’s about $3.5B USD in lost revenue and profit (assuming equal costs) for NAND suppliers. And the difference between a 25% and 35% YoY is currently about $0.02/GB in lost revenue and profit, or $7B USD.. Ouch!

The problem is that suppliers cannot accurately predict demand and they sometimes under or overestimate. In 2016-17, they underestimated and there was a shortage. However, in 2018-19 they overestimated and that led us to the current oversupply we are in.

For OEM customers, oversupply situations are great; OEMs can buy parts for less money and either pass on those cost savings to the end-customer, or pass along the extra profits to their investors. NAND vendors would prefer to keep supply and demand roughly balanced to avoid these huge swings. To address excess supply, some NAND suppliers will try to dump inventory in the channel; This is great but it ends up getting absorbed into competing products to the NAND suppliers that eventually drives down prices for all verticals.. so this only addresses the smallest of oversupply situations.. Definitely not 5 exabytes of inventory!

Solution

My proposition is simple (and it DOES NOT cannibalize existing business).. I propose that the NAND industry dump their excess NAND into a market that doesn’t compete with the existing verticals being served, while preserving revenue and profit. Where could this unicorn dumping ground be? No, it’s not IoT. I prefer to look at existing opportunities that have a need to store data but aren’t yet ready to be attacked by SSDs.. And lucky for us, large portions of the hard drive market are still untapped, like oil fields waiting to be discovered.

There are two markets that are not being directly served by SSDs: 7.2K and 10K RPM HDDs. I know what you are thinking.. 10K HDDs have been disrupted. No doubt, but mainly due to data reduction technologies in enterprise storage. But, what I’m talking about is $/GB to $/GB equality and/or $/unit equality, or close enough to create more demand when needed (like in an oversupply situation). Most of these $/GB and $/unit opportunities are predictable and already go into the NAND planning process.. So, we need something else.

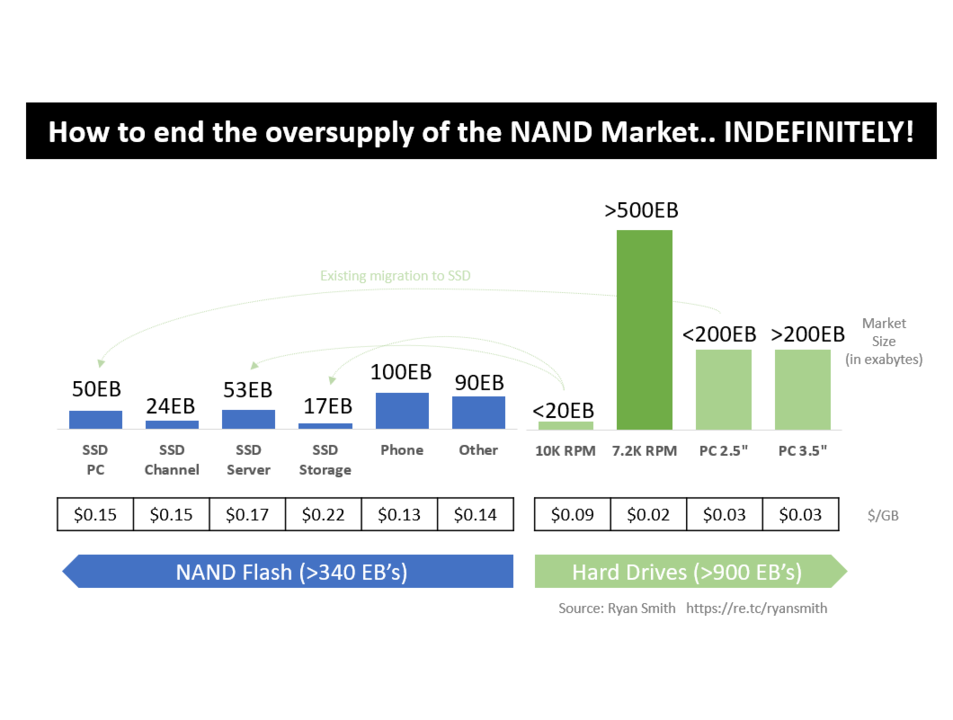

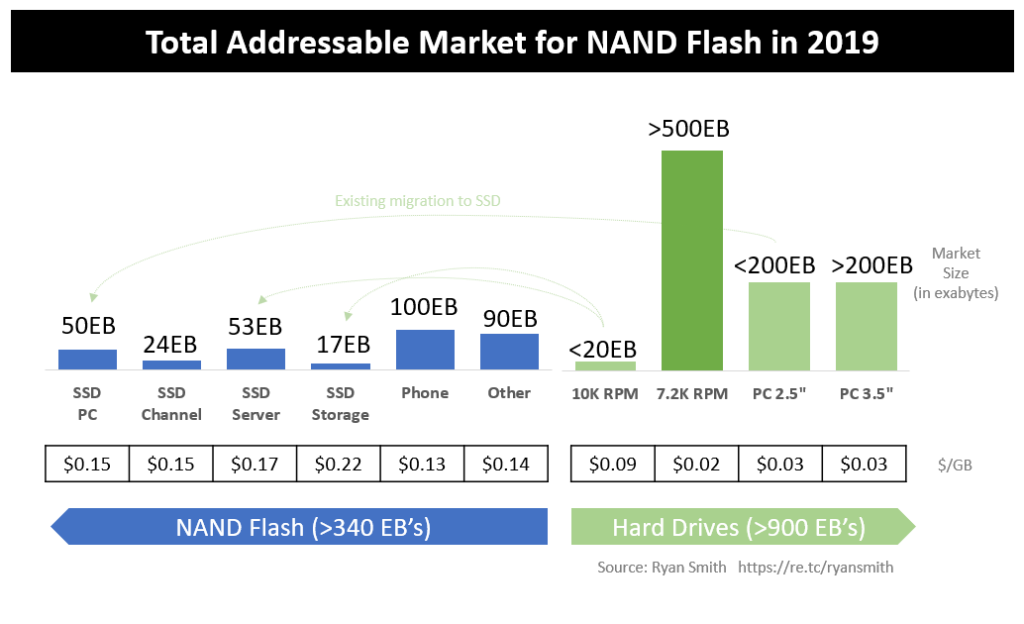

Let’s take a look at the current addressable market for Flash, how much total demand each of those markets command, as well as the going price for each GB of capacity.

As you can see, there is still well over 900 exabytes of hard drive business waiting for the right $/GB or $/Unit to get taken out by SSDs. The problem with all of these hard drive markets is that the prices are way too low for SSDs to attack. But look at that excessively large 7.2K HDD market; that would be nice to tap into if NAND suppliers needed to dump supply; But they have avoided this market because of the low $0.02/GB price point. And looking at it as a an individual market, that is the correct conclusion to come to.

You see, the cost of 64L NAND (the type of NAND Flash that’s used in most of the market today) is around $0.08/GB and most of the remaining opportunities in the HDD market have prices that are much lower.

The lowest SSD prices I can think of are PC SSDs which go below $0.10/GB but large capacity PC HDD drives are at $0.03/GB.

Enterprise-grade SSDs are between $0.14-$0.22/GB so it would be hard to attack the 10K RPM at $0.09/GB on a $/GB basis with the appropriate solution. And I wouldn’t recommend lowering pricing here as NAND suppliers risk reducing their steady-state high margin business since the going price of SSDs is approaching 10K HDDs already; and already factored into NAND production plans so really doesn’t help any future excess inventory. On top of that, to dump 5 exabytes into a 20 exabyte market is a 25% market takeover and that is a tall order even for the most ambitious.

But, what if NAND suppliers could sell into that 500 exabytes of 7.2K HDD only when needed to flush out excess supply? And do so at the going rate of $0.02/GB. That sounds crazy to sell at such a price well below cost, but it all works out for the better. They just have to look at the overall picture and the effect on the overall market. NAND suppliers would obviously be taking a loss on selling this individual solution, but the gains they get on every other vertical will more than make up for it. All because there is no excess supply that causes prices to drop more than normal.

As you can see, by removing the excess 5 exabytes from the market at $0.02/GB, NAND suppliers would bring the market from 35% YoY price erosion to 25%. This increases revenue and profitability by a factor more than $0.02/GB thereby making it a great solution to oversupply situations. In fact, I calculated that NAND suppliers can dump up to 100 exabytes this way and still work out better than an oversupply. If you want to see the details behind it or change any assumptions, please feel free to download my model here and play around:

Download the Excel (XLS) Model by clicking here

What would the $0.02/GB 7.2K-like SSD look like?

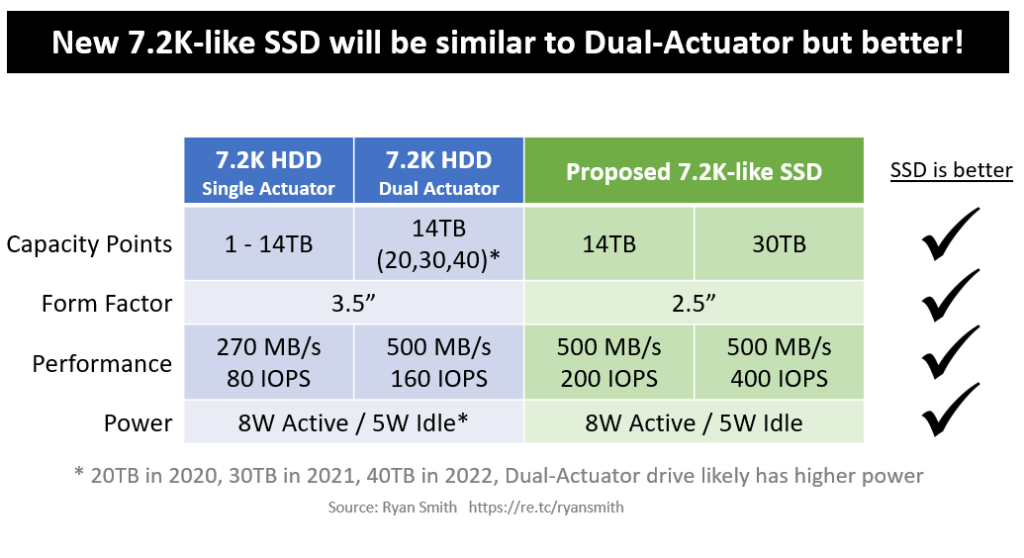

NAND suppliers don’t want to just plop an SSD into the market that gives all the benefits of an SSD. If they do this, they will unintentionally cannibalize their existing SSD business. Remember, these 7.2K HDD customers want price, not an SSD. So give customers an HDD-like experience but slightly better. This way NAND suppliers don’t erode their existing market where customers buy SSDs for the SSD-like characteristics.

I specifically like the 7.2k dual actuator opportunity for flushing excess NAND components since it adds value to the customer and NAND suppliers are not eroding their existing business. By limiting performance, they are not giving the customer an SSD experience. But they are giving slightly better than the most modern, state-of-the-art, dual-actuator HDD. According to Seagate, customers want 10 IOPS/TB so offer that or slightly better. They can give the customer the large densities they crave with the minimum level of performance that will take years for the HDD vendors to provide. A side note: I think NAND suppliers would ship more >16TB SSDs here than they would anywhere else. Using the SSD costing calculator I created, this new SSD would be roughly $0.09/GB in total costs to make when using your standard SAS/SATA/NVMe controller at the proposed densities.

The market size of the 7.2K HDD segment is >500 exabytes (and growing) so NAND suppliers only need to capture 1% of the market to dump 5 exabytes (using 2018’s excess as an example). Very achievable for even the least ambitious.

The other artifact is that it lets NAND suppliers learn more about this use case so when they are ready for it, years from now with the appropriate cost structure, they will hit the ground running.

The only problem (maybe there are others?)

The problem with this idea is that end customers may be reluctant to adopt 7.2K-like SSDs, even at that incredible price of $0.02/GB and all the great benefits of high densities with >10 IOPS/TB, because they will realize that this is simply a mechanism that NAND suppliers can employ to manipulate overall market pricing, whether it be to balance the market or do something more mischievous like create shortages to raise the overall market price at will.

The great thing is, NAND suppliers have three different verticals they can approach to see which one has a customer that will bite: hyperscalers (7.2K and 7.2K dual actuator replacement), server vendors (7.2K and 10K replacement), and PC vendors (3.5” large capacity replacement). As an example, they could work with one or more large hyperscalers to guarantee them a predictable YoY price drop on their run rate business if they take excess supply with the 7.2K-like SSD. This would force the rest of the market into a tight market.

The key thing for NAND suppliers is to not market this drive nor drive [I love puns way too much] lots of attention to it. They only need to find one or two customers that will take this drive, and let them know it’s only available when there is excess supply. Nobody else has to know about it. 🙂

I know this is a wild idea ( I have these daily! Way too many to post.. ) so I welcome criticism or alternative thoughts.

I have been around IT since I was in high school (running a customized BBS, and hacking) and am not the typical person that finds one area of interest at work; I have designed databases, automated IT processes, written code at the driver level and all the way up to the GUI level, ran an international software engineering team, started an e-commerce business that generated over $1M, ran a $5B product marketing team for one of the largest semiconductor players in the world, traveled as a sales engineer for the largest storage OEM in the world, researched and developed strategy for one of the top 5 enterprise storage providers, and traveled around the world helping various companies make investment decisions in startups. I also am extremely passionate about uncovering insights from any data set. I just like to have fun by making a notable difference, influencing others, and to work with smart people.