Summary:

- There are six major trends that are converging right now that are going to negatively impact the size of the SSD market in the near future

- The number of large customers of Flash (1B GB and up) have dramatically increased and will cause the OEM SSD business to “pop” and convert to low-margin NAND component business.

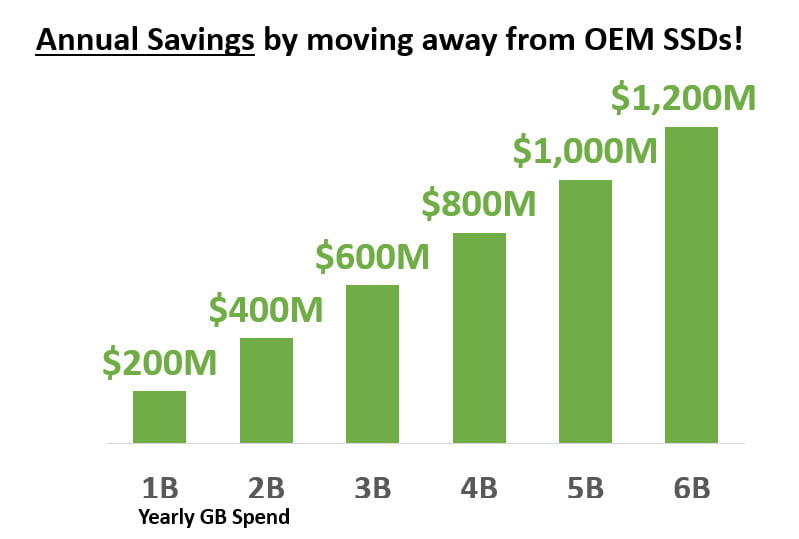

- These new “Flash Billionaire” OEM customers can save a minimum of $200M per year by reading this article and buying third party SSDs, building their own SSDs, or having someone build it for them.

You really should read more…

The NAND Flash shortage we just came out of in Q4’17 definitely forced OEM customers to revisit their Flash strategy. CEO’s were bringing up the shortage of NAND Flash in their earnings calls throughout 2017; thank goodness that has come to a close. Everyone is now getting all the Flash they need and you don’t even see it mentioned anymore on earnings calls (however, Roku still recently mentioned NAND Flash on their earnings call).

However, one problem has stuck around: NAND Suppliers are trying as much as possible to hold onto the higher prices they commanded during the shortage.

We are definitely seeing more aggressive pricing behavior right now from those trying to displace incumbents with 64L-based SSDs and I expect you to see some stronger than usual market share shifts on SSDs starting in Q2’18, with even more pronounced shifts in Q3’18.

However, there is a bigger problem for the NAND market lurking than simply losing market share on SSDs.

There are a multitude of trends (way too many to ignore!) that are causing OEM Customers to start thinking about getting rid of traditional SSDs all together. Now you think I’m crazy, right? As a matter of fact, it’s already started to happen and it’s about to become even more prevalent than you think.

Let’s take a look at the trends that are all converging that are allowing OEMs to join the movement to abandon NAND Supplier-based SSDs and move to third-party, purpose-built, and/or piecing together their own SSDs:

Six Major Trends

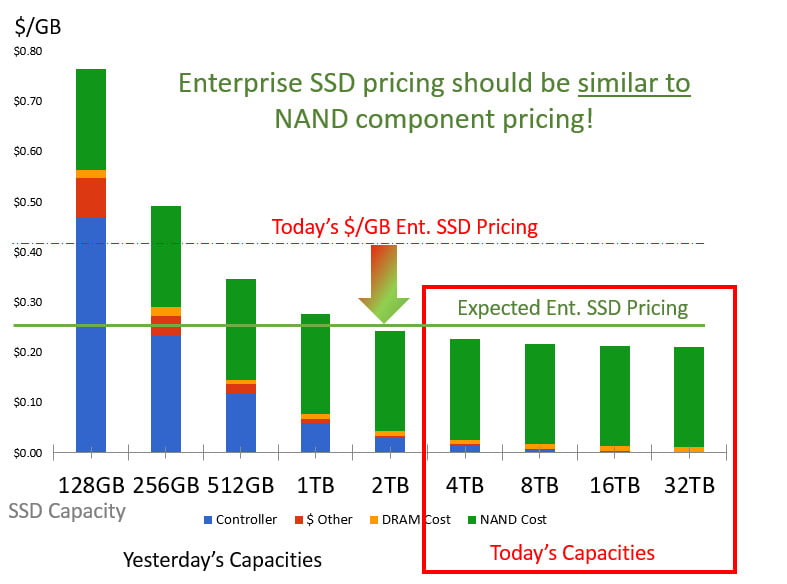

1. Enterprise SSD capacities are commonly 4TB and moving to 8TB & 16TB

NAND Suppliers continue to double their SSD densities. And thanks to the yearly doubling of densities, this trend significantly reduces the cost overhead of non-NAND related components that would typically go into an Enterprise SSD (or even client and datacenter SSDs)

As you can see, non-NAND costs are negligible on higher density drives:

Wow, the costs of an SSD are mainly NAND now (the green). This means all the NAND suppliers are holding on to higher pricing strategies on Enterprise SSDs based on yesterday’s densities and associated overhead costs.

Assumptions in graph above:

$/GB DRAM: $9 $/GB NAND Flash: $0.20

$/Controller: $60 (Hyperbole! Should be lower!) $/Other (PCB): $10

2. Adoption of NVMe

You can thank Intel for initially driving this protocol and others for fast-following. If you are going to make an investment into your own SSD, we are at the beginning of the adoption of NVMe and your investment will pay dividends well into the future. Even if you don’t need the performance, NVMe is basically a free upgrade (in terms of production costs) over other interface types; although you wouldn’t know that from the premiums that NAND suppliers are trying to charge for NVMe! NVMe was designed to be more efficient, yet NAND suppliers have somehow thought they can charge a premium for these drives. They don’t cost more to produce, they are less complex to implement.. so why are they charging more?

The good news is that there are tons of NVMe SSD controllers available to enable 3rd party or custom options, and they are very mature and reliable.

3rd party SSD Controller vendors:

Microsemi PMC Sierra (best choice for dual-controller NVMe and used by major dual-port and single-port NVMe adopters)

Silicon Motion [Popular]

Phison [Popular]

Marvell

CNEX Labs [Light NVM, Open-Channel]

3. 3D-NAND is now mainstream

Shrinking NAND in the planar days sure was a challenge to deal with at the controller-level. This made it a wise decision to go with a NAND supplier’s vertically integrated SSD because they were tightly integrated and had access to “test modes” that let them customize the NAND during operation.

3D-NAND, on the other hand, has larger NAND cells, with plenty of endurance and voltage-level retention, and each generation isn’t dealing with the same shrinks that were happening on planar. Instead of the “old school” shrinks, NAND suppliers add more layers to cut costs. This makes going to third-party based controllers much easier to adopt.

If you haven’t looked at third party SSD makers in awhile, you may be wise to revisit them as an option. As an example, Lite-on has done quite well in the PC OEM and Datacenter space over the past few years.

In fact, “Other” NVMe SSD suppliers (defined by me as SSD vendors with less than 10% M/S) adoption has grown by 25% in 2017. Compare that to the 50% decline in the SATA segment; quite the opposite trend on NVMe!

4. NAND Flash Shortage

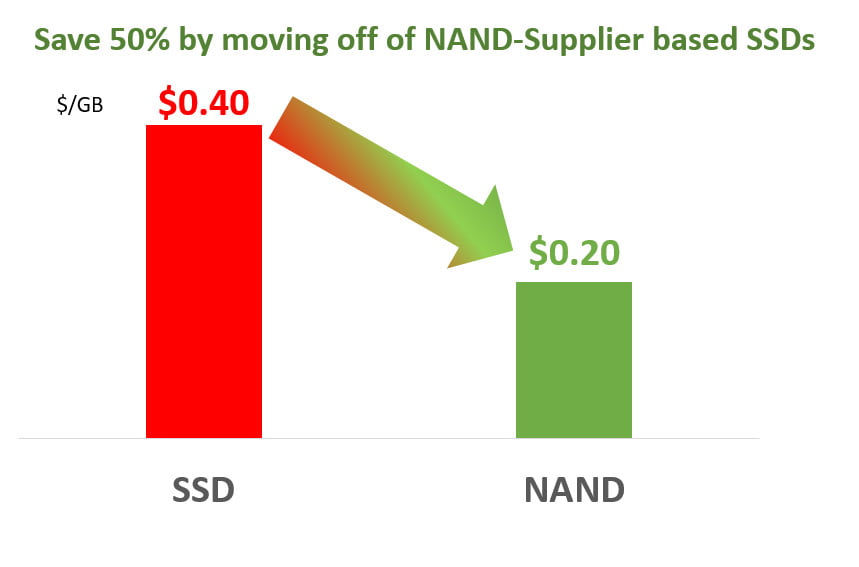

In the aftermath of the shortage, some NAND Flash suppliers are continuing to charge a significant SSD premium over NAND Flash components:

Anecdotally, I have heard of “high quality” NAND being sold for ~$0.20/GB to a large buyer of NAND Flash in Q4’17. Even lower, I heard of under $0.15/GB for a large datacenter customer in the 2018 timeframe. Ouch.. That’s just a tad lower than the $0.40/GB Enterprise SSD.

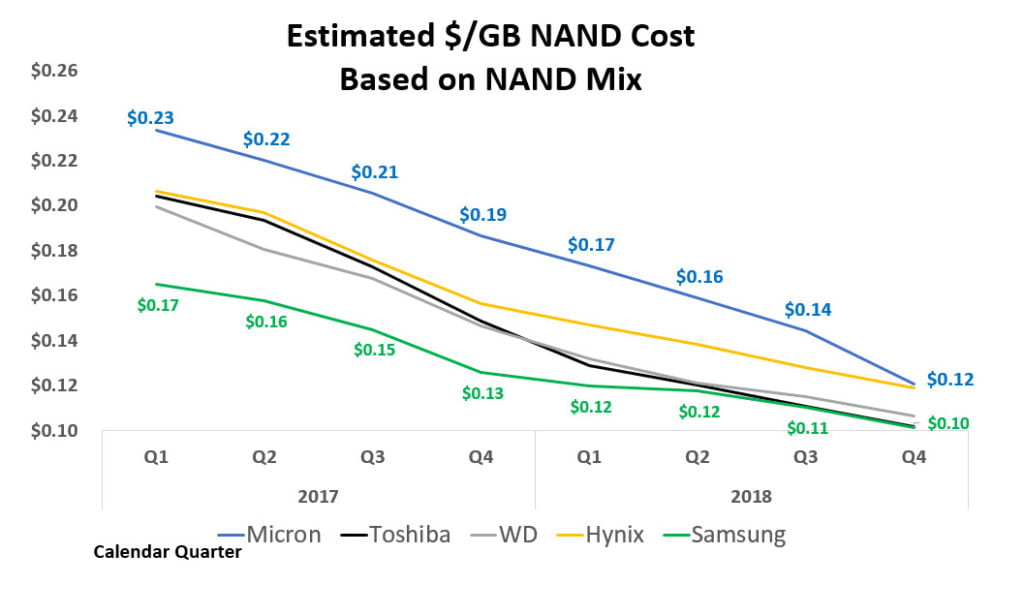

Check out the average NAND costs, by supplier, below (costs are even lower for current generation 64L):

5. NAND Flash “Billionaire” customers are rapidly increasing

With NAND Flash getting significant attach rates in PC, Datacenter, and Enterprise Storage, the amount of customers that buy over 1B GB’s (1 Exabyte) of Flash is growing every year.

Flash “Billionaires” candidates:

See Memory big spenders here (2/7/2018 Silicon Angle article)

This means the extra $0.20/GB being charged by NAND suppliers is amplifying the Billionaire’s costs.. by a lot! The more GB’s you buy per year, the more amplified the $0.20/GB surcharge hurts your company’s profit margin. If you were lucky enough to barely make it into the billionaire’s list, you can save over $200M/year!!

How much NAND would move away from SSDs in total if all the big spenders moved to component NAND?

If you are buying 1B GB (ore more) of Flash today, you really need to look closely at your buying behavior because your spend will only increase quickly over time.

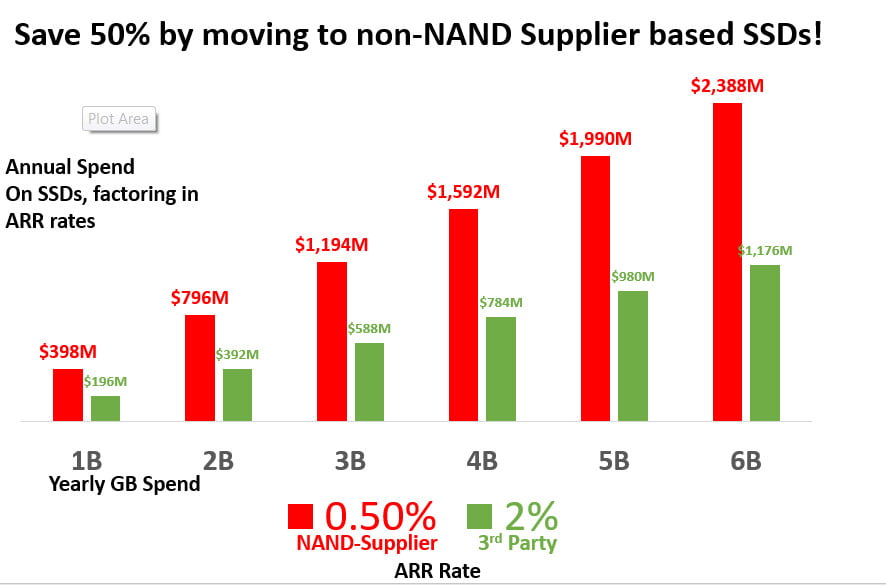

Doing fifth-grade math, SSD customers can save 50% by simply moving off of NAND-Supplier SSDs. This is even factoring in a 4x higher [hyperbolic] annual return failure rate (ARR)!!

You tell me.. If you were buying 1B GB of SSD per year, what would you rather save?

$6M/year by buying “vertically integrated” SSDs w/ a superior 0.5% ARR

..or..

$200M/year from not over-paying NAND-Suppliers for their “vertically integrated” solutions

It’s no wonder that Apple (the biggest Flash customer) moved to their own custom solution years ago.

6. Customers are already moving away from NAND suppliers

Here is a list of known Flash customers that already have their own SSD solutions, or appear to be in the process of transitioning:

- Amazon (AWS) (continuing to hire SSD engineers)

- Apple (Annobit)

- Google (see analyst market share reports)

- Hitachi (FMD)

- IBM (MicroLatency module)

- Microsoft (CNEX Labs)

- Pure Storage (FlashBlade)

- Etc, Etc

Note: Some Flash customers listed above may still be buying traditional SSDs, in addition to their custom SSD solutions

In short, you are not alone in thinking about straying from the “old school” behavior of buying SSDs from NAND suppliers! The billionaires are doing it.

Although I focused on Enterprise, these trends and analyses will relate to the PC and Datacenter segments as well.

I will now assert that we are at the beginning of a new phase for the OEM SSD market: The movement from SSDs to custom in-house SSD/Designs.

In conclusion, there are five possibilities that could play out here:

- You keep paying a higher price for OEM-based SSDs (unlikely with the abundant solid [pun intended] choices mentioned)

- You move to more cost effective third-party SSDs

- Integrate an off-the-shelf controller, firmware, DRAM, NAND or have an SI (system integrator) do it for you

- Build a custom SSD w/ customized ASIC/FPGA, firmware, DRAM, and NAND (only do if you think you can add real value beyond off-the-shelf options)

- NAND suppliers finally realize what’s happening and significantly adjust their pricing downward on SSDs closer to component pricing.

Which path do you think is the right one to take?

I have been around IT since I was in high school (running a customized BBS, and hacking) and am not the typical person that finds one area of interest at work; I have designed databases, automated IT processes, written code at the driver level and all the way up to the GUI level, ran an international software engineering team, started an e-commerce business that generated over $1M, ran a $5B product marketing team for one of the largest semiconductor players in the world, traveled as a sales engineer for the largest storage OEM in the world, researched and developed strategy for one of the top 5 enterprise storage providers, and traveled around the world helping various companies make investment decisions in startups. I also am extremely passionate about uncovering insights from any data set. I just like to have fun by making a notable difference, influencing others, and to work with smart people.