Download the 401K Employee Contribution Calculator now

Ever wonder what the ideal percentage you should be contributing to your 401K is? It’s more difficult than you may think and you might accidentally be losing out on employer contributions.

Things you need to consider:

- Employer Matching level (e.g., 50%, 100%)

- Max Employer Matching (e.g., 4%, 5%, 6%)

- Any absolute max your Employer will match up to (e.g., $6K)

- True Up Payment Risk

- Your income level

- Do you plan on leaving your company mid-year?

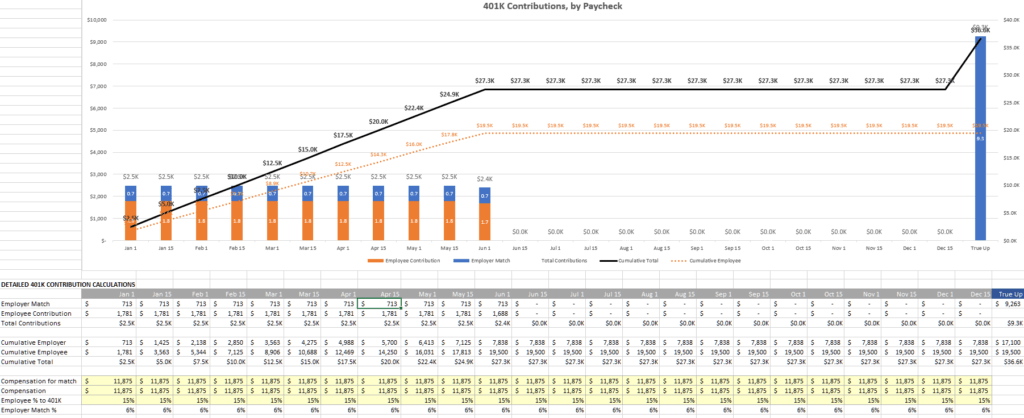

Ideally, you want to spread out your contributions across the year, while maxing out your employer matching to avoid True Up risks (read more about this here)

This 401K calculator does all the work for you, including showing you what your employee and employer 401K contributions (regular and True Up) are throughout the year.

Download the 401K Employee Contribution Calculator now

If you have any questions, let me know!

I have been around IT since I was in high school (running a customized BBS, and hacking) and am not the typical person that finds one area of interest at work; I have designed databases, automated IT processes, written code at the driver level and all the way up to the GUI level, ran an international software engineering team, started an e-commerce business that generated over $1M, ran a $5B product marketing team for one of the largest semiconductor players in the world, traveled as a sales engineer for the largest storage OEM in the world, researched and developed strategy for one of the top 5 enterprise storage providers, and traveled around the world helping various companies make investment decisions in startups. I also am extremely passionate about uncovering insights from any data set. I just like to have fun by making a notable difference, influencing others, and to work with smart people.

Can you call me and talk to me about my 7% my company is gonna match me please thanks