I have maxed out my 401K every mid-year since I was in my mid-20s and thought I was doing the right thing. What could be wrong with investing in the stock market sooner and getting a bump in pay when you max out mid-year? So last year, I decided to be even more aggressive and I maxed out my 401K by March!

I didn’t realize how stupid this was until I learned a little bit more about employer matching and how it works.

Note: You can download the 401K Contribution Calculator to customize all the charts you see in this article for your specific needs.

Bigger paychecks mid-year

This is often the first thing I hear when it comes to why people max out their 401K by mid-year. You get a little bump in pay after you max out at $19,500 (the IRS max in 2020). I have experienced this for most of my working career and do have to admit it feels like getting a yearly self-created pay raise. And there is no harm in doing this.. if your employer doesn’t match your contributions.

As an example, an employee earning $285,000 (filing SINGLE) and contributing 15% to their 401K will take home about $5,710/paycheck (assuming no cost medical benefits). When they cap out their 401K contributions at $19,500 in June, their paycheck will then become $7,443/paycheck. That is an extra $1,733 per paycheck (in this example, this employee would have their Social Security and CA SDI tax limits hit so those phase out at the same time). Nice.

How did I calculate this? Easy.. I used a paycheck calculator I created that will predict your entire year’s paychecks based on your personal salary and benefits selections.

Employer matching

In their race to be more competitive for obtaining and retaining talent, employers have been offering 401K matching for awhile now. This is absolutely a great perk that I feel isn’t fully understood by employees. This can easily be over $17,000 in extra tax-deferred pay to highly compensated employees.

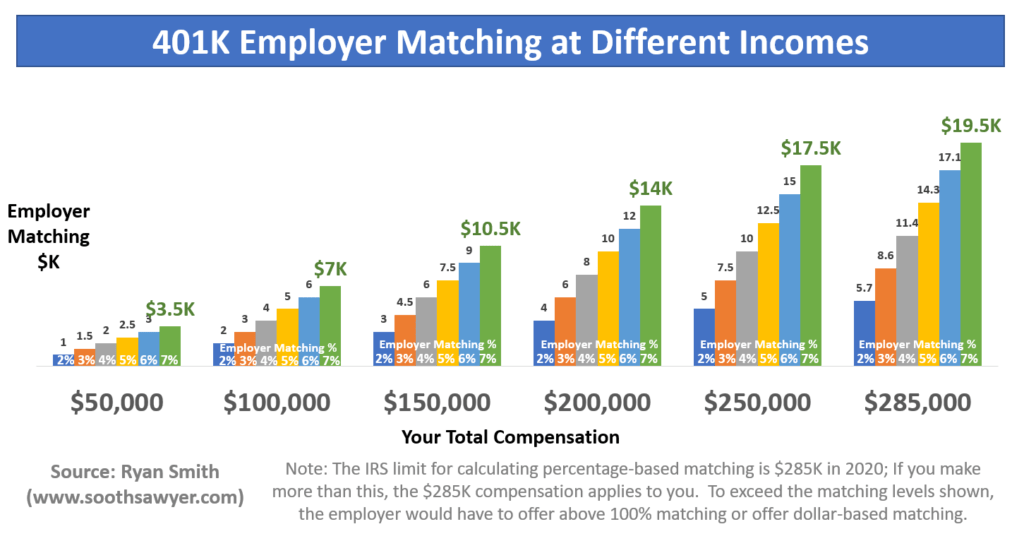

To illustrate how great matching can be, here are example yearly 401K matching figures at different income levels and common matching percentages. This is based on 100% matching. I’ll cover other scenarios in a later post.

Can’t see the image above? Click here to enlarge

The max income that employer matching percentages can be calculated from is $285,000 in 2020 (IRS rule), so if you make more then you should simply use the $285,000 grouping for you. I know, it’s so unfair.

As you can see, if your company matches 100%, up to 6% (like my company does), if you make $285,000 or more, you can get employer-based matching up to $17,100 per year! Some employers have caps on how much they will max out to, so read through the details of your plan or prospective employer and then use the contribution calculator for your tailored needs.

Maxing out your 401K before the end of the year

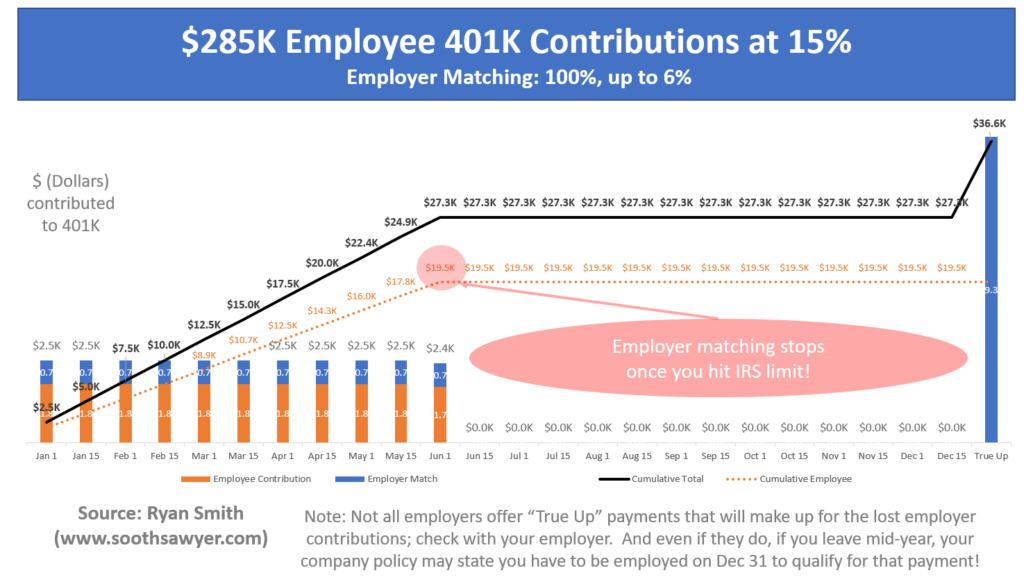

There is a downside to maxing out your 401K mid-year: your employer may stop matching your contributions!! To illustrate this, here is an example employee that makes $285,000 and chose to contribute 15% of their paycheck to their 401K and their employer only matches 6% of the employee’s contributions. Because of their income level and the contribution choice they made, they will max out their employee contributions by June 1st.

Can’t see the image above? Click here to enlarge

Notice that employer matching stops on June 1st. 6% employer matching of $285,000 is $17,100 and by June 1st, the employer had only provided matching contributions of $7,838. What??? This means that this employee lost out on contributions of $9,263 because they maxed out mid-year. And that is where a “True Up” payment comes in.

True Up Payment

True Up payments make up the employer contributions that were missed if you maxed out mid-year. This is a payment that typically happens early in the following year; for me it happens in February. Not all employers offer true up payments so I recommend you check with your benefits coordinator or HR department to be sure. If they don’t offer True Up payments, in the example above, this employee would have lost out on $9,300 unknowingly. Ouch.

In general, I would advise avoiding True Up payments, even if your employer supports them. At my company for example, I have to be employed on Dec 31st of the year to qualify for the True Up payment. If I leave in December, and I maxed out in March, all those would-be employer matches that I missed out on go down the tube. Big mistake. Why take unnecessary risk?

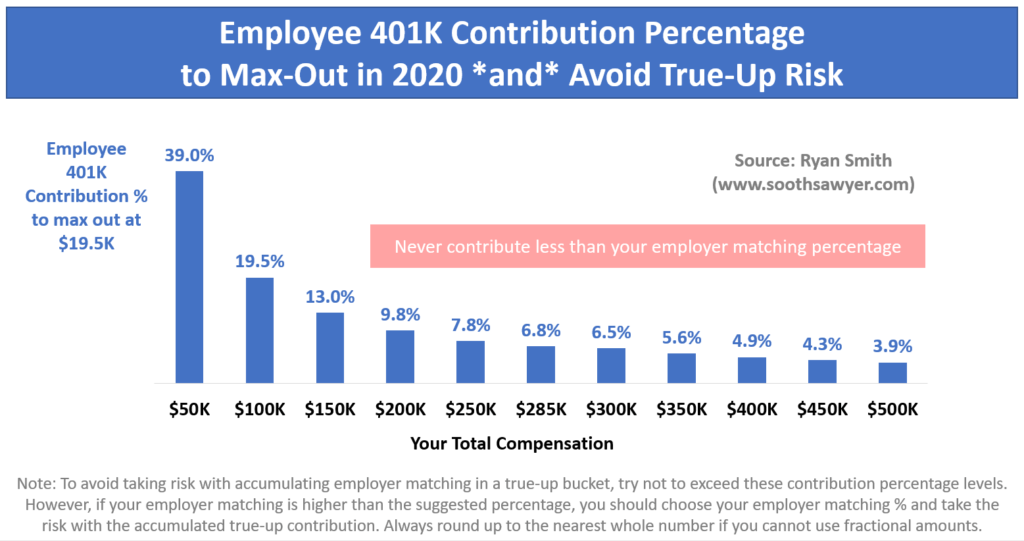

What percentage should you contribute to your 401K?

So, what should you choose for your employee contribution percentage? Good question. I have provided you with a quick and dirty chart that illustrates what the max percentage you should contribute to your 401K to max out your employee contributions and get the maximum employer matching throughout the year, while avoiding as much as possible the True Up risk we discussed earlier. However, never contribute less than your employer matching percentage (I recommend using the calculator for your specific needs).

Can’t see the image above? Click here to enlarge

Well, there you have it. Please note that this article only covered employer plans that match 100% of contributions up to X%. If your employer matches 50% up to X%, or some other exotic matching plan, this article will not directly apply. If you have anything you want covered, just comment below and I’ll try to answer your questions.

You can also download the Excel-based 401K contribution calculator that I created to come up with the charts above, and you can put in your specific information in there and get customized charts just for you! (including 50% matching, max matching by employer, etc).

I have been around IT since I was in high school (running a customized BBS, and hacking) and am not the typical person that finds one area of interest at work; I have designed databases, automated IT processes, written code at the driver level and all the way up to the GUI level, ran an international software engineering team, started an e-commerce business that generated over $1M, ran a $5B product marketing team for one of the largest semiconductor players in the world, traveled as a sales engineer for the largest storage OEM in the world, researched and developed strategy for one of the top 5 enterprise storage providers, and traveled around the world helping various companies make investment decisions in startups. I also am extremely passionate about uncovering insights from any data set. I just like to have fun by making a notable difference, influencing others, and to work with smart people.

Hi Ryan, what you would think of 401 contribution if no matching at all? Also how beneficial is to contribute to 401k from the bonus as a lump sum rather than monthly from paychek?

So if your employer matches only once at year end you should be able to max out day one correct?

Different employers offer different true up schemes.

For example, my employer offers a true up with each pay check! That is, even if I max out my contributions in February, for the rest of the year, I still get the employer matching contribution with each pay check as if I had contributed that pay period.

The analysis is more complicated. Yes, it depends on the true up, but also on the likelihood of being with the employer for the full year. Having sufficient resources saved in taxable accounts to live off of, I’d hate to have enjoyment separation midyear and not have already put $26k into a 401k by then!