Download the Excel-based Paycheck and Tax Forecasting Tool by clicking here

For those that know me, one of my passions is personal finance (along with public speaking, influencing, practical applications of technology, data analysis, helping others). As I have grown older, I have come to appreciate the importance of planning taxes and choices around income/deductions more carefully.

I was always especially frustrated with the lack of tools out there that would tie all of these things together:

- Paychecks:

- Retirement Contributions (and the choices of Roth vs Traditional)

- Deferred Compensation Contributions

- ESPP Elections

- W4/DE-4 Elections

- Lumpy bonuses (e.g., quarterly, yearly, incentive-based)

- Investment Income (the impact this has on your income tax withholding)

- My wife’s income (dual income household and the difficulty this causes in insufficient tax withholding)

- Tax Year Obligations (aka Tax Return)

Because of this, I decided to build my own tool (screenshots and download link to XLS at bottom or by clicking here) that would allow me to quickly change any variable in my work/investment life and see how it will affect me come next April 15th. In conversations I had with people, it seems like most people would not know what they would owe to the IRS until they handed all their paperwork to their CPA after that tax year! That is not planning.. that is reacting. I wanted more and I wanted to demystify this so I can confidently know my tax situation even a year before the following April 15th.

In addition, I was always amazed by the seeming complexity that surrounded the TCJA (recent tax law changes) that affected TY2018 and the misinformation being constantly spread about who benefited from that (especially caused around the changes to the withholding tables, tax brackets, and SALT limits).

I also created another version of this tool that helps me calculate various inputs rapidly and I can quickly see who benefited from the new tax law (I have done 1000’s of variations of income levels $50K-700K, dual/single income, homeowner/renter, various house sizes/mortgages); I’ll likely post this sometime in the near future to share some of the insights from that.

Until then, please try out the tool (all in Excel) and let me know your thoughts. This tax/paycheck calculator should handle most cases of people’s tax situations. By no means is this meant to replace or do the job of TurboTax or your CPA. This tool is meant to tie paycheck income /deductions/withholding/spousal income to your tax return so that you can prepare better by modifying your deductions, contribution, and W4, for example; All before it’s too late after the tax year.

In short, this tool should handle the following:

Paycheck Prediction for entire year

- Predicts bi-weekly or semi-monthly paychecks, including:

- Take home pay (check deposited into your bank)

- W2 wages

- 401K phase-out after threshold reached

- Medicare Surcharge

- Social Security Tax phase-out after threshold reached

- 401K Traditional/Roth

- Non-Qualified Deferred Compensation

- RSUs

- HSA Contributions

- ESPP (including proper taxation at time of purchase)

- Common deductions (e.g., Medical, Dental, Vision, Voluntary XYZ)

Paycheck predictions feed into Tax Return that handles these scenarios:

- Single or Dual-Income Families

- Automatic determination of Standard vs Itemized Deduction

- Connect your paycheck withholdings, including W4 settings, to your future tax return

- Investment Income Tax (aka Obamacare tax)

- Qualified and Ordinary Dividends

- Long Term Capital Gains

- Short Term Capital Gains

- Child Tax Credit / Thresholds

- SALT (State & Local Tax) Deduction Limits

- Interest Deduction Limits

- 401K Contributions / Limits

- State Tax Withholdings (currently set to California)

- Federal Estimated Tax Payments

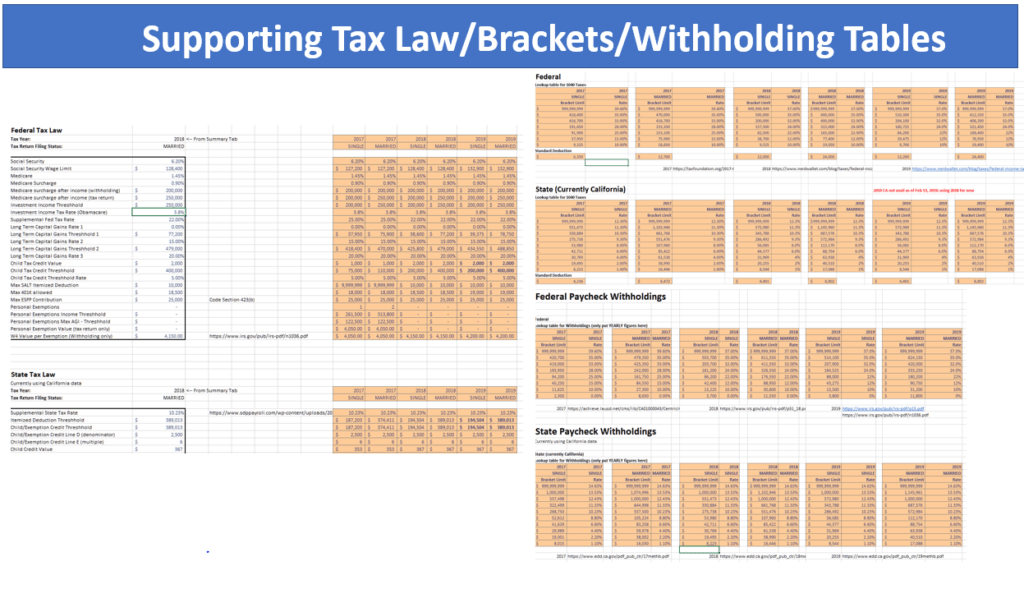

Easily updated for every tax year:

- Currently has 2017, 2018, 2019 most common tax law, Income Brackets, Income withholding tables for Federal and California.

- Should sustain new tax law and withholding changes fairly easily thru easily configurable binary tables, as well as married/single tax year law/bracket/withholding tables.

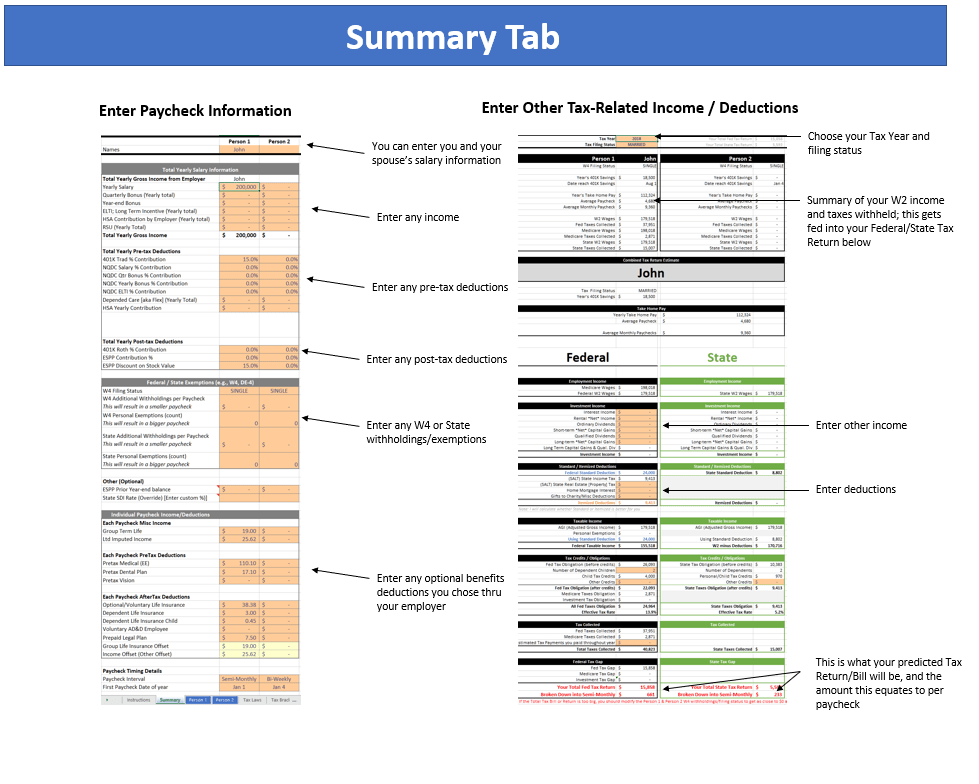

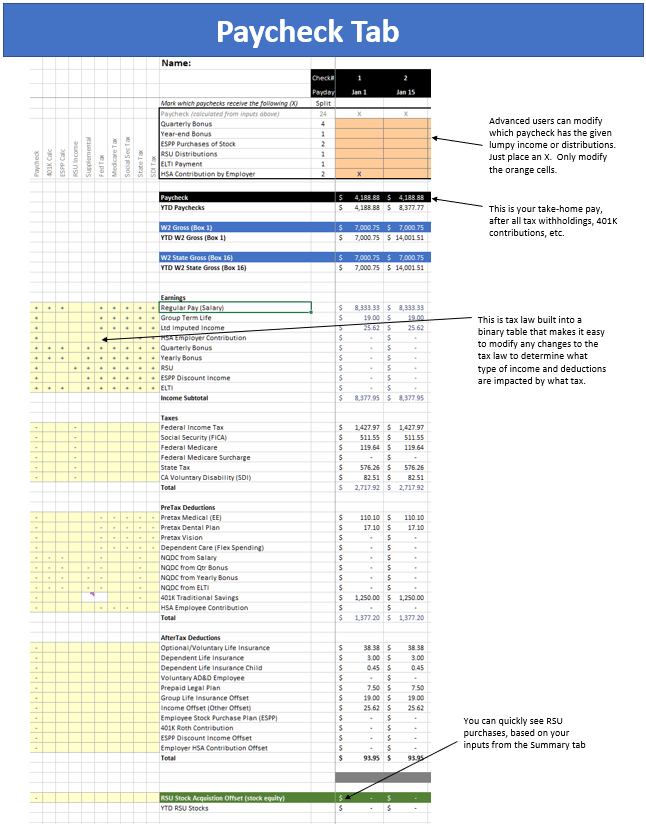

To get started using the tool, you only really need to use the “Summary” tab and fill out any or all of the orange cells. If you want to predict actual paychecks more accurately (not necessary unless you want to see how big your bonus check will be, for example) then you can modify the orange cells on the “Person 1” and “Person 2” tab by moving the X’s and which paycheck bonuses fall on.

Please let me know if you have any questions/feedback on the tool, as I feel like I have developed a completely unnecessary understanding of the tax law and its impact on the general US population. It makes for great dinner conversation with friends. 🙂

Download the Excel-based Paycheck and Tax Forecasting Tool by clicking here

Here are some screenshots of the tool:

I have been around IT since I was in high school (running a customized BBS, and hacking) and am not the typical person that finds one area of interest at work; I have designed databases, automated IT processes, written code at the driver level and all the way up to the GUI level, ran an international software engineering team, started an e-commerce business that generated over $1M, ran a $5B product marketing team for one of the largest semiconductor players in the world, traveled as a sales engineer for the largest storage OEM in the world, researched and developed strategy for one of the top 5 enterprise storage providers, and traveled around the world helping various companies make investment decisions in startups. I also am extremely passionate about uncovering insights from any data set. I just like to have fun by making a notable difference, influencing others, and to work with smart people.